Opinion

Infractions Bothering On Employees’ Taxes & Payment Of Accrued Financial Considerations On Shareholding By Thor Explorations Ltd Of UK (Thor) And its Subsidiaries

By Wale Bolorunduro, PhD

(The subsidiaries are Segilola Resources Operating Limited (SRIOL or Segilola) & Segilola Gold Limited (SGL), Operators of Segilola Gold Project (SGP) by Osun State Government)

Today, Thursday 26th September, 2024, the Government of Osun State has no choice than to inform the Osun public about our findings on the Thor Explorations UK and its Segilola Gold Project operated by Segilola Resources Operating Limited (SROL or Segilola). SROL is a company, domiciled in Nigeria, that operates the Segilola Gold Project (SGP), located in Iperindo, Osun State Nigeria. SROL is a subsidiary of Thor Explorations Ltd.(Thor), United Kingdom, a gold exploration and development company, listed on both the TSX Venture Exchange of Toronto (TSX-V:THX) and AIM Market of the London Stock Exchange (AIM:THX).

It is appalling to discover non remittances of taxes deducted as PAYE taxes from its employees and that of the employees of its service providers/ operators, under the Personal Income Tax (PITA) and non compliance with the disclosure requirements under the extant law on taxation. The infractions, which cannot be tolerated for Thor, SROL and other associates in other jurisdictions are being perpetrated here, in Osun state. These include failure of Segilola Resources Operating Limited (SROl) to remit, the balance on the 3.2 Billion Naira tax liability of the four (4) year (2019 – 2023 ) Interim assessment due to the State since 4th of July 2024 under the relevant tax law of the federation and that of the state as Pay as You Earn (PAYE) and the Withholding taxes (individuals) deductions, required to be remitted to the state(s) or federal under Personal Income Tax (PITA) and Company Income Tax (CITA).

Shirking of its statutory responsibility to provide within 15 days, the basic tax Information/documents to substantiate its dispute of the 3.2 billion Naira tax liability such as: (a) The official Gazette from tax authority permitting the 5% of mining accommodation as Benefit in Kind (b) Breakdown of the Operating Cost by vendors, stipulating Name of vendors, Cost, Type of services and the amount paid to vendors, The address of vendors, etc (c) Evidence of remittance of withholding taxes (d) Submission of the General ledger/ activity reports and trial balances to verify salary and nominal payroll. These documents have been outstanding since 11th July, 2024, despite the fact that the onus of proof is on the tax payer (SROL) according to Personal Income Tax Act (PITA). This is a deliberate attempt to delay payment and allegedly to evade taxes on direct and indirect employees, contrary to section 81(3) of PITA.

Non disclosure of all the service providers, operating in the same location and on the same Segilola Gold Project, who are providing services to SROL by direct or indirect recruitment and via outsourcing of employees. Thereby, allegedly hiding employees under these service providers and allegedly evading corresponding PAYE Taxes due to Osun state. While Sinic Engineering Ltd has been evasive, ATF Consulting Limited has failed to pay fully the 160 million Naira, undisputed interim tax liability Demanded by Osun state but rather paid partially 100 million Naira and abandoned the outstanding since August 26th,2024. The company, ATF has refused to pay for Business Premises levy, claiming they operate within Segilola’s premises. The progressive assessment established against the company, ATF has increased the tax liability to 436 million Naira as tax intel trickles in. Other operators such as Monurent Nigeria Limited, Deep Rock Drilling Services and CEFO Security Limited are yet to present themselves to Osun state tax authority and we can not find their records of self assessment as requested by the tax laws. These are clear violations of section 64 of CITA on the premises of Segilola Gold Project, operated by Segilola Resources Operating Limited (SROL) and a subsidiary of Thor Explorations UK.

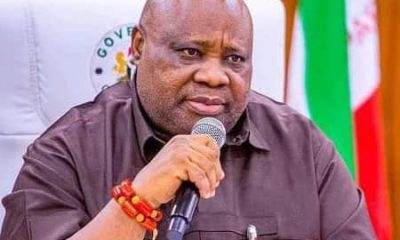

The Governor would like to assure the public and the media that due process has been followed and in accordance with the extant laws of the Federal Republic of Nigeria on Personal Income and Company Income Taxes. The Agencies of Government and their technocrats have carried out proper assessments; the review and meetings had been held to encourage Segilola and its associates to pay promptly, while the onus of proof remains with them, according to the extant laws on taxation.

Regrettably, the Company, SROL has engaged in subterfuge to allegedly evade tax by failing to disclose, fully, its service providers, using the same premises and their corresponding tax information required by the state for proper tax assessment of their employees, staff and labour. This has reflected in the delay and extra work that the government officials had to go through. An obstruction under section 97 of PITA. The State Government had no choice than to take action now, no matter how temporary or subtle, on the failure of the company to provide tax information on the 3.2Billion Naira, Four (4) year PAYE Assessment and withholding tax (individuals) remittance, on full disclosure basis to the Government since 11th July, 2024 deadline given to the company. Despite the fact that the burden of proof is on the taxpayer (Segilola), according to the Personal Income Tax Act (PITA); we have done our best. How Thor Explorations Ltd U.K with Disclosure requirement, mandated by virtue of its public listing on London and Toronto stock exchanges couldn’t rein in its subsidiaries and operators on its premises in Nigeria, is still a nightmare to the state government.

Also, it is unfortunate that Thor Explorations Ltd of United Kingdom listed on London and Toronto Stock Exchanges will allow its subsidiaries and associates on Segilola Gold Project to embark on an unholy structuring of their payroll, commercial activities without full disclosures of all operators, allegedly to evade the tax payments due to Osun state. We are alarmed that what cannot be condoned in other jurisdictions is being carried out by Thor Explorations, U.K and its operatives in Osun state. The various extant laws on taxes gives statutory power to states to collect taxes and levies on employees salaries and certain commercial activities without prejudice to The Minerals and Mining Act. Therefore, Osun state will do whatever is legal, no matter how temporary, it is to fulfill the statutory obligation of the government to Osun state citizens. We don’t want them out of Osun state but they must fulfill their obligations and responsibilities to Osun state.

In the same vein, but purely commercial, It was Segilola Resources Operating Limited that carried out strategic annihilation of Osun State‘s interest in the ownership of the Tropical Mines Limited (TML) in 2016 and the eventual Commercial transaction of Transformational Acquisition by Thor Explorations Limited (Thor) UK, without due financial considerations to Osun State. While other legacy co-shareholders of Tropical Mines Ltd got financial considerations for the Commercial Transaction, which includes Shares in Thor Explorations Ltd UK and other financial considerations; Osun state got nothing, based on our review of the transaction, which commenced in early 2023.

For the past twenty months, the company, Segilola has refused to honour its commitment to commence payments on the accrued financial considerations due to Osun state on the Transformational acquisition of Osun interest between 2016 and 2019. Even, when a tenor repayment plan payable over two years was offered by Osun state Governor to them to preserve the need to encourage the national and the state investment drives in the mining sector. The efforts and demand of Osun state to realize our claims, which is over 60 billions Naira in monetary value and Redeemable shares as financial considerations for acquiring Osun state’s interest in Tropical Mines Ltd have always been rebuffed by Segilola Operating Resources Ltd. At least four (4) meeting had been held with the Executive Governor, H.E Governor Adeleke and the CEO of SROL, Mr Segun Lawson in attendance and with promises made to commence payment. Only for the company to renege on its Promises and chose to go and misrepresent the state in Abuja, Ministry of Solid Minerals.

At the initial stage of our claims, in early 2023, Segilola said we were not entitled to any shares of Thor Explorations Ltd UK; it was after confronting them with facts and figures that they agreed that Osun state has bonus shares, which is 5.1million shares of Thor Uk. We have said, assuming we take that share allocation without conceding, what about other financial considerations given to other shareholders, Segilola has been evasive and whenever, they appear, they always direct Osun state to Tropical Mines Ltd (TML), a company, whose assets had been stripped by Segilola without “winding it down”. So how can TML take liability to pay Osun State, again?. Directing us to TML offends our collective sensibility as people with culture and dignity. It is the responsibility of Thor UK to return the values which ought to have been given to Osun State abinitio. As co-shareholder in Thor, UK. Osun deserves to treated with fairness, equity and without prejudice to our interest. Let no mischief makers, political oppositions especially Osun APC spin it, in their usual dirty way. Recovering Osun interest and encouraging a global company, (though a junior Miner) to treat its co-shareholder properly is proper under company law and in any jurisdiction. The fact that Thor has admitted a shareholding proportion, which is significant in the Legacy Company, Tropical Mines Ltd makes Osun state a significant shareholder.

All we are saying is that Osun state has capacity to de-convolute the complex structure employed to gradually, strip the osun state’s interest between 2016 and 2019. We know the roles played by various special purpose vehicles (SPVs) that were set up, including Segilola Resources Operating Limited , Segilola Gold Ltd and the eventual transformational acquisition by Thor Explorations Ltd, UK. Unlike the previous administration, we are not interested in selling Osun’s interests, which include the shares, partially redeemed, now and grudgingly so by Thor Explorations UK from the complex and multiple-convoluted commercial transaction. We will continue to pursue the cash considerations and others, due to Osun state, without loosing our dignity and without compromising our integrity.

The State Governor, H.E Senator Ademola Jackson Nurudeen Adeleke has met with the CEO of Segilola Resources Operating Limited, Mr Segun Lawson, severally and directed the commencement of the payment of claims due to Osun state, only for the company to go to the Federal Ministry of Solid Minerals to mis-represent the issue, allegedly, to evade making good their commitment. Thor UK has listed Directors and ownership can be obtained from its Company Registrar, so for Osun APC members that are full of gibberish and cynicism, they can go and check, if Adeleke are in Thor Explorations UK, in any form, directly and indirectly. I can tell you for free; they were not involved in 2016, when the transformation was done, they were not involved between 2016 and 2019, when Segilola Gold Project, the Project company was packaged and made bankable.

The state under Governor Ademola Adeleke had made official submission in writing to the Federal Ministry of Solid Minerals and other federal agencies on the commercial transaction of stripping Osun interest in the Tropical Mines Ltd and our claims, which has nothing to do with the operation of The Nigeria minerals & Mining Act, an exclusive right of Federal Government. During the last visit to the Federal Ministry of Solid Minerals, to be specific, on the 15th of August 2024, the Federal technocrats including the Permanent Secretary and Directors of the Federal Ministry of Solid Minerals agreed with Osun state contingent that we are free to make our commercial claims on such legacy interest and rights of the state under the shareholding of the legacy Tropical Mines Ltd, now complexly transformed as Thor Explorations UK. The current government of Osun state is not interested in chasing away Thor Explorations UK, out of Osun state or shut down Segilola Gold Project, No!! Governor Adeleke is clear headed and sincere on this; we will encourage them to improve on their business and operational practices, so as to become Senior Miner and bring values to Osun state as its co-shareholders. That’s what private companies do.

The amiable Governor of Osun state, HE Senator, Ademola Jackson Nurudeen Adeleke has always said he is only interested in the collection of Osun monies for Osun developments and progress. He has also said he is not interested in the time wasting probe, required to determine the transaction that led to the stripping of Osun State‘s interest in the ownership of the Tropical Mines Limited (TML) in 2016, but rather, the Governor is focusing on the amount due in two parts as (a) financial considerations on the commercial transaction and (b) the taxes due to the state under Personal Income Tax Act (PITA) as PAYE and levies payable to states under the extant laws of the Federation and the state. We will not hesitate to petition the Securities Exchanges of Toronto and that of London for our claims and use our statutory power on PAYE collection.

Osun state will like to assure the public that all these amount due from Segilola have nothing to do with mineral rights under The Nigeria Minerals and Mining Act that are strictly under the legislative power of Federal Government of Nigeria (FGN), called The Nigeria Minerals and Mining Act. The mineral right over the mine is still intact as vested by the Federal Government and under the beneficiary of the Operating Mineral License (OML), I.e Segilola. We will try to avoid the diversionary tactics of Segilola, which is to place the Osun State Government in collision with the Federal Government through blackmail and mis-representation. We will continue to support the national drive to encourage investment in the solid mineral sector, especially in a responsible and sustainable manner, while protecting Osun state’s interest. Let Segilola pay the PAYE taxes and the accrued financial considerations due to Osun State, from the stripping of our interests in the legacy asset company, the Tropical mines Ltd (TML).

We have escalated our claims on Osun state’s shareholding interest to Thor Explorations Ltd UK, a publicly quoted company in London and Toronto stock exchanges. Our Expectation is that the Chairman of Thor Explorations UK will compel the Company Secretary and Segilola Resources Operating Ltd or its “Alter Ego” on the board of Thor to resolve the issues with Osun state by delivering our due considerations to us. That is the best global corporate governance practice, asking Osun state, a shareholder to wait again to do a meeting in another 30 days with Thor Explorations UK Board is tantamount to unfair treatment in a manner that is prejudicial to our interest and rights as shareholder. We salute the courage of our finding fathers, who invested Osun’s money and kept faith with the developmental works that enabled it to become an investible asset class.

As a responsible government we shall continue to monitor the environmental impacts of Segilola exploration, drilling, developmental and mining activities because Environment is under the concurrence list of the Constitution of the Federal Republic of Nigeria (FRN). We will allow the Federal agencies to monitor this in line with its guidelines, while we expect Segilola Gold Project Operators to comply with the Osun state protocol on environmental impacts also. We have concerns in the area of high level of particulates in the air, possible acid drains from the waste rocks, etc. We have claims on environmental levy and we will soon publish our inspectorate report, once access is granted to the site.

-

Crime5 days ago

Crime5 days agoVigilante Reportedly Shoots Colleague Dead In Plateau

-

News3 days ago

News3 days agoRamadan: Osun Cleric Urges Compassion Among Muslims As Asejere Distributes Relief Materials To 537 Beneficiaries

-

News2 days ago

News2 days agoOkemesi Dies After Slipping Into Coma

-

Crime3 days ago

Crime3 days agoCourt Commits Man To Life Imprisonment For Kidnapping Judge