News

Jaiz Bank Doubles Net Profit To N23.5b

Indimi, Kolawole join board

Nigeria’s pioneer non-interest bank, Jaiz Bank Plc has recommended 75 per cent increase in dividend payouts as net profit doubled to N23.48 billion in 2024.

Key extracts of the audited report and accounts of Jaiz Bank Plc for the year ended December 31, 2024 released at the Nigerian Exchange (NGX) showed significant growths across all key performance indicators with net profit rising by 109 per cent from N11.05 billion in 2023 to N23.48 billion in 2024.

Gross earnings rose by 86.5 per cent to N82.87 billion in 2024 from N47.24.4 billion in 2023. Income from financing contracts moved from N17.1327.36 billion in 2023 to N32.04 billion in 2024. Income from investment activities grew significantly to N44.36 billion in 2024 from N17.16 billion reported in 2023.

The board of the bank recommended increase in dividend per share from 4.0 kobo in 2023 to 7.0 kobo for the 2024 business year.

The balance sheet of the bank emerged stronger with total assets exceeding the N1 trillion mark to N1.08 trillion in 2024, a significant increase of 86.3 per cent from N580.13 billion declared in 2023. The 86.3 per cent growth in Jaiz Bank’s total assets was driven by primarily by N349.6 billion investment in Sukuk in 2024, a growth of 129.7 per cent from N152.2 billion in 2023 and N493.6904.79 billion customer current deposits in 2024 as against N466.57224.46 billion in 2023.

Underlying ratios showed improved profitability and operating efficiency, with Jaiz Bank’s return on equity (ROE) closing 2024 at 34.21 per cent from 28.12 per cent in 2023 while return on assets (ROA) stood at 2.26 per cent in 2024 from 1.91per cent in 2023.

Jaiz Bank’s Capital Adequacy Ratio (CAR) stood at 23.87 per cent in 2024 from 17.96 per cent in 2023, while liquidity ratio (LR) moved from 37.24 per cent to 47.35 per cent in 2024.

Managing Director, Jaiz Bank Plc, Dr Haruna Musa, said the bank has been well-positioned to compete effectively on all fronts and meet customers’ needs through fair and ethical financing.

According to him, despite the challenging operating environment, the bank continues to enhance its performance across all indices, recording significant growth in both financial and non-financial metrics.

“We remain on track to become the leading ethical bank in Africa. We will continue to focus on strengthening our relationships with our customers while attracting new ones, supporting not just individuals and businesses but also our communities through digital platforms and innovative products and services.

“We are confident in our journey to lead the future of ethical finance in Africa and will not relent in our commitment to excellence while delivering long-term value to all stakeholders,” Musa said.

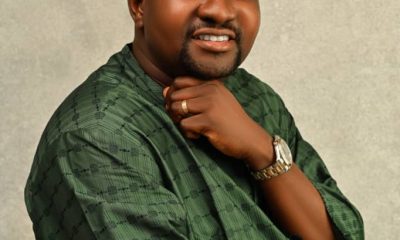

Meanwhile, the board of the bank has appointed Ahmed Mohammed Indimi as a Non-Executive Director, and Nike Kolawole as an Independent Non-Executive Director.

The bank stated that the appointments were made to enhancing its leadership with professionals; experienced individuals with track record of ethical and strategic engagement.

Indimi, a respected entrepreneur and business executive in Nigeria’s energy sector, currently serves as the Director and Head of Crude Marketing at Oriental Energy Resources, where he leads commercial operations; oversees crude sales strategy; negotiates pricing frameworks; and fosters client relationships.

His leadership in the sector reflects a strong blend of technical understanding, commercial insight, and stakeholder engagement.

He holds a Bachelor’s degree in Information Technology (Internet Security) and an MBA from the American InterContinental University, Atlanta, after completing his foundational studies at Global International College, Lagos.

Indimi brings on the board of Jaiz Bank a unique perspective shaped by hands-on experience in one of Nigeria’s most strategic sectors. His appointment supports the Bank’s ambition to deepen industry expertise on the Board and broaden its vision of ethical banking in alignment with national development objectives.

The bank noted that Kolawole’s appointment, duly approved by the Central Bank of Nigeria (CBN) reflected the bank’s continued commitment to strengthening its governance, enhancing expertise in ethical finance, and accelerating its growth trajectory.

According to the bank, Kolawole’s experience included successful tenures at leading international institutions such as Merrill Lynch, Citibank, Goldman Sachs, and Credit Suisse, where she served as Vice President, overseeing asset management, credit risk, and Eurobond issuances across global markets.

In 2007, she joined the Nigerian National Petroleum Corporation (NNPC), where she rose through key finance roles to become Group General Manager, LNG Investment Management Services. Over her tenure, she led critical project financing efforts and helped reposition Nigeria in the global LNG market, including landmark transactions such as the award-winning 2012 RDP Funding deal.

Kolawole holds a Bachelor’s degree in Economics from Suffolk University, Boston, and an MBA from Durham University Business School, UK. She is also a registered member of the UK’s Securities and Futures Authority (now FCA).

“Her appointment brings to Jaiz Bank a rare combination of investment banking acumen, deep sectoral knowledge in project and infrastructure finance, and a proven track record of capital mobilization and stakeholder engagement at the highest levels of industry,” the bank stated.

Chairman, Jaiz Bank Plc, Mohammed Mustapha Bintube, expressed delight at the appointment of Indimi, noting that his commercial acumen, sectoral knowledge, and long-term view on investment and governance would be a great asset as we continue our mission to lead in non-interest banking and value-based financial services in Nigeria.

He said: “We are honoured to welcome Nike Kolawole to the Board of Jaiz Bank. Her exceptional expertise, integrity, and strategic insight will be invaluable as we continue to drive our mission of providing ethical, inclusive, and value-based banking in Nigeria and beyond.”

-

News5 days ago

News5 days agoAfolabi Celebrates 50th Birthday With Humanitarian Outreach

-

News5 days ago

News5 days agoFrom Community To Chamber: Ayodeji Abdulahi Olaiya And the Making Of A Legislative Contender In Osogbo

-

News5 days ago

News5 days agoAyodeji Abdulahi Olaiya (Ayonic): A Beacon Of Hope In Osogbo

-

News5 days ago

News5 days agoOsun: South-West NASC Commissioner, Oluga Urges APC Members To Participate In Ongoing e-Membership Registration