News

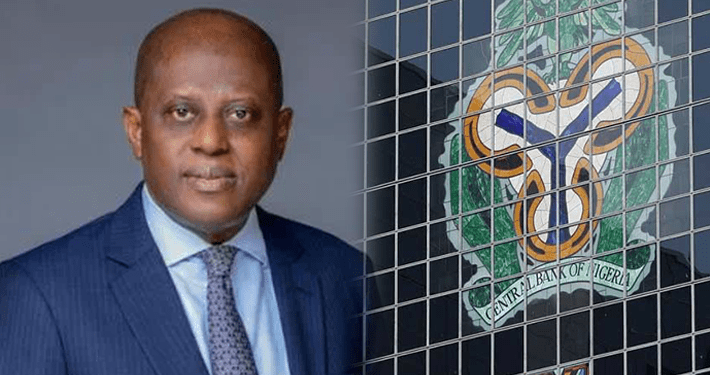

Breaking: CBN Sacks NIRSAL MD, Directors

–Shakeup Elicits Panic

There is a massive management shake up at the Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRSAL Plc) on the order of the Governor of the Central Bank of Nigeria (CBN), Mr Olayemi Cardoso.

Saturday Telegraph reliably gathered that three sitting Directors which made up the management have been sacked, an insider source who craved anonymous disclosed this.

Affected Executive Management comprises Managing Director and Chief Executive Officer, Abbas Umar Masanawa; Kennedy Nwaruh, Executive Director, Operations; and Olatunde Akande, NIRSAL Plc’s Executive Director, Technical.

The development has sent panic waves amongst the rank and file employees of NIRSAL, with many unsure if sacking of the top three most senior personnel would , mark the beginning of the first tranche of layoffs.

“Yes, there was a shake up announced on Friday evening. Most of us got to know of the development via email.

“There was supposed to be a board meeting yesterday morning which was never held I’m sure by Monday, the picture will get clearer. For now, everything is still on wraps” said our source.

NIRSAL Plc is a non-bank financial Institution wholly owned by the Central Bank of Nigeria (CBN). It was created to redefine, dimension, measure, re-Price and dhare agribusiness-related credit risks in Nigeria .

The agency is mired in corruption allegations with its pioneer Managing Director, Mr. Abulhammed Aliyu is currently facing corruption allegation charges filed by the Economic and Financial Crimes Commission ( EFFC) at the court.

Last month a private Consultant Dr. Steve Olusegun Ogidan returned N1.5 billion to the EFCC to avoid conviction in a case involving former NIRSAL MD, Aliyu Abdulhameed, citing it as legitimate earnings from consultancy services.

The EFCC pursued interim forfeiture of the funds, alleging they were proceeds of unlawful activities, while Ogidan and Abdulhameed argued the money was rightfully earned under a PMRO contract approved by NIRSAL’s board.

-

News4 days ago

News4 days agoRamadan, Lent: Shettima Calls For National Unity And Compassion

-

Opinion4 days ago

Opinion4 days agoReinventing Osun’s Economy Through Dagbolu Intl. Trade Centre: From Quiet Market Lessons To Regional Trade Revolution By Adeboye Adebayo

-

News4 days ago

News4 days ago‘Wike Factor’: Another PDP Chairmanship Candidate Steps Down For APC In FCT

-

News3 days ago

News3 days agoInsecurity: Kogi Schools Resume On Monday