News

Osun Hoteliers Lament, Say COVID-19 Lockdown Paralysed Hospitality Businesses

By Olalekan Akindoju, Osogbo

Hotel business falls under the hospitality industry and it has been identified as one enterprise that can boost the economy of a nation if the potentials are properly harnessed.

But in the past few months, this kind of business has been faced with extreme difficulties as a result of several restrictions occasioned by a need to curb a spread of the novel coronavirus.

In March 2020, states in Nigeria imposed bans on public gatherings, forcing the cancellation of events and activities, while in April, President Muhammadu Buhari banned interstate travel, except for those on essential services.

These measures have however led to loss of revenue for hotel owners, with several workers also losing their jobs.

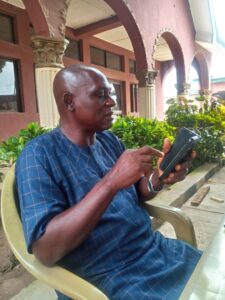

Remi Adekunle owns Regina Suites in Osogbo, the Osun state capital, in south-west Nigeria, and he says the restrictions have had a terrible effect on his business.

“My projection for this year… I don’t think I can meet up in the next three, four, five years, because of this pandemic,” he states while exclaiming during an interview.

According to Mr Adekunle, the hotel has lost between four to five million naira in expected revenue on a monthly basis for the past three months, while he has continued to run electricity bills.

He adds “during this pandemic period, I have lost a lot, because we are not opening, and at the same time, we still run the NEPA (electricity) bills, we still use generators and some workers still have to come to maintain the hotel, as well as security.”

In March, the Central Bank of Nigeria unveiled a 50 billion naira COVID-19 Targeted Credit Facility, while the Osun state commissioner for Commerce, Industry and cooperatives, Bode Olanipekun, confirmed to this reporter that the state government had set aside funds to assist businesses with soft loans.

According to him, “the state has partnered with Bank of Industry, let the bank administer the money, but the state has provided it.”

However, Mr Adekunle is not open to taking loans to sustain his hotel business, as he questioned the need for incurring more debt at this period, as he stressed that “if the government wants to help hoteliers, government has to start their programmes.”

The situation is also not different for Adejoke Olaoye, the female owner of ABM hotel in Ede, Osun state, as she had to shut down her hotel for months.

“We had to shut down the hotel due to fears that we may be fined by the authorities,” Mrs Olaoye notes in brief remarks over the phone.

Prior to the COVID-19 lockdown, hotel occupancy across the globe had started to slow, and the downturn seen in the industry at this period is undoubtedly one of the most challenging for even the most experienced hoteliers.

Olusola Oyewole is the Chairman, Ede, Ejigbo, Egbedore hotel owners association in Osun state, and he does not see the possibility of recovering the losses suffered by the business in the past three months, anytime soon.

“We have never had it so bad in this hotel business, since the establishment of this hotel in 2006,” the hotelier who appeared downcast, states.

Mr Oyewole, who owns Bafoo Hotel owner in Okinni, wants government to make available avenues for hoteliers to access low interest loans.

He disclosed that his hotel was owing staff about five months wages, noting that the pandemic has contributed to the unemployment rate in the country, as many youths are engaged by hotels.

He adds that “it is impossible to recover this year unless the government decides to make the economy work.”

Nigeria confirmed its index COVID-19 case on February 27, 2020, but the number of infections passed 20,000 on June 21, with 518 deaths recorded.

Though hotels have begun reopening as the country eases restrictions, but until the ban placed on gatherings, events and inter-state travel are lifted, hotel business owners may need to continue to face the challenge of keeping their enterprise afloat, while also battling to lessen the rate of job losses in the sector.

-

News5 days ago

News5 days agoMay Day: Babayemi Praises Tinubu Over Salary Increments

-

News4 days ago

News4 days agoNNPP, Kwankwaso Behind Purported Suspension Of APC Nat’l Chairman- Basiru

-

Opinion5 days ago

Opinion5 days ago…Of Osun Poly, WAEC, NECO, JAMB And Half-Baked Matriculated Products By Tope Abiola

-

Crime19 hours ago

Crime19 hours ago‘I’ve Killed Over 500 People And Was Paid To Kill The Owner Of A Pure Water Factory’- Suspect Confesses