News

Tax Collection: Osun Govt Warn Banks Against Sabotage

Osun State Government has warned some commercial banks against frustrating the collection of taxes, levies and other related charges through them.

The Chairman and Chief Executive Officer of Osun Internal Revenue Service, Mr. Dayo Oyebanji gave the warning at a stakeholder meeting held with the management of banks in the state including the state Accountant General and Auditor General both for state and local governments across the state.

Oyebanji said that the unwilling attitude of some banks’ officials in collection of taxes, rates, levies and others related charges by the affected banks is frustrating and sabotaging government’s effort to generate more revenue in the state for the purpose of infrastructural development in the state.

The Chairman of Osun Internal Revenue Service explained that report has reached the board that some banks licenced to be collecting taxes and levies are found of complaining bad internet network whenever people come to pay their taxes and levies adding that the attitude is frustrating and out to sabotage the government’s projects and payment of salaries to workers.

He further said that some banks also were found of deliberately delaying the collection before transferring the money into the coffers of the government thereby slowing down the collection and distribution of money.

Oyebanji noted that the incessant excuses of bad internet network is not tenable to the government adding that bank is not expected to delay people that want to pay taxes and levies and issuance of automated revenue receipt for them.

He, however, called on the residents of the state that anybody paying should immediately verify the validity of the receipt at the board office at government secretariat or any tax station of the board.

Oyebanji said that all issues relating to fraudulent receipt or revenue leakages should be reported to his office immediately.

He further called on tax defaulters across the state to do the needful by paying all their outstanding revenue to the coffers of government as soon as possible stressing that at the appropriate time the board will not hesitate to deal with defaulters according to the law.

-

News4 days ago

News4 days agoAlaafin Must Respect Olubadan Stool or Face Consequences – Ibadan Traditional Leaders

-

Entertainment4 days ago

Entertainment4 days agoPopular Gospel Singer, Bunmi Akinnanu Dies

-

News4 days ago

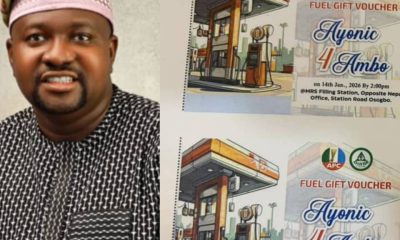

News4 days agoBirthday: Hundreds Of Osogbo Residents To Benefit Ayodeji Olaiya’s Free Fuel Distribution

-

News4 days ago

News4 days agoEkiti 2026: Court Voids PDP Guber Primary, Orders Fresh Poll