News

Court orders banks to disclose Zamfara’s account status

The Federal High Court in Lagos yesterday directed banks to disclose how much Zamfara State government has in its accounts with them.

Justice Okon Abang gave the order following a garnishee application by Ecobank Nigeria Plc.

The court had ordered Zamfara to pay the bank N3.1billion which it owed it.

The state has, however, appealed the judgment.

The judge directed the Central Bank of Nigeria (CBN), the Ministry of Finance and Accountant-General of the Federation to deduct the sum from the money accruable to the state from the Federation Account and remit it to the bank.

In addition, the state must pay 10 per cent interest on the judgment sum until it is liquidated, the judge ordered.

The judge awarded N50,000 to the bank as cost of prosecuting the suit and directed the Attorney-General of Zamfara, Ministry of Finance, Accountant-General, Attorney-General of the Federation and CBN “to ensure the full and effectual compliance with the judgment.”

Justice Abang held that N3, 159,017,740.71 was the outstanding indebtedness on a facility of N1.5billion extended to Zamfara State by Oceanic Bank Plc, which was consolidated with Ecobank.

Ecobank, in its claims, said the state’s Executive Council passed a resolution authorising its Finance Ministry to accept the loan on Zamfara’s behalf.

It said the major security for the disbursement of the loan facility was a conditional Irrevocable Standing Payment Order (ISPO) from the state’s Value Added Tax (VAT) account domiciled with First Bank, Gusau branch.

Ecobank said the facility suffered a setback when First Bank “stopped the warehousing of state Federation Account Allocation Committee (FAAC) and consequently declined further remittance for the payment of the indebtedness that arose from the subject facility.”

An agreement was subsequently reached to restructure the debt in November 2010, after which the state “honoured rentals for a few months.”

“However, the rentals to date have not been paid by the Zamfara State government despite that same have fallen due,” the bank said.

Following the judgment, the bank, through its lawyer, Mr. Kunle Ogunba (SAN), prayed the court for an order nisi attaching the accounts of the judgment debtors/respondents to the garnishees.

The applicant wants the court to order the banks to pay the debt directly to Ecobank from Zamfara’s accounts.

Granting the order, Justice Abang ordered that the garnishes (the banks) should disclose forthwith the sums outstanding or that may accrue to Zamfara in their accounts.

Each of the banks should make such disclosure on oath, verified by an affidavit filed before the court, the judge held.

He directed the banks to appear before the court on the next adjourned date to show why an order should not be made for them to pay Ecobank the money.

The bank, in a supporting affidavit, claimed that Zamfara “has not taken any steps to satisfy/liquidate the judgment sum.”

It said it discovered that Zamfara maintains an account with all the banks in the country.

“It is only through the attachment of the judgment debtor’s accounts with the garnishes that the judgment creditor/applicant can reap the fruit of its hard- earned judgment entered on September 30, by this honourable court,” Ecobank said.

The banks are: Zenith, Access, Citi, Standard Chartered, Wema, Union, First Bank, Skye, Enterprise, Sterling, Unity, Keystone, UBA, Mainstreet, FCMB, Diamond, Stanbic IBTC, GTB, Fidelity and Ecobank.

Justice Abang adjourned till November 6 when all the banks must appear before him.

-

News5 days ago

News5 days agoOmoluabi Progressives Rallies Support for 2026 Political Takeover, Welcomes New Members Across Osun State

-

News3 days ago

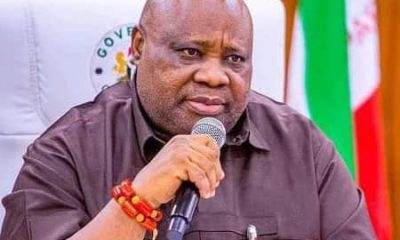

News3 days agoAdeleke’s Bitter Critics Are Enemies Of Osun Progress- Group

-

News2 days ago

News2 days agoMakinde Inaugurates 480 Amotekun Forest Rangers

-

News5 days ago

News5 days agoProposed LG Election: Osun APC, 19 Others Drag Gov Adeleke, OSSIEC To Court